If you operate a Georgian business that purchases services from abroad, then you need to declare and pay Reverse Charge VAT (18%) in your monthly declarations to the RS. You must do this even if your business is not VAT-registered.

By not declaring, you are breaking the tax law. And, for most businesses owned by foreigners, you could claim back the VAT. So, breaking the law for something that would effectively cost you no money is not a good plan.

Who Pays Reverse Charge VAT?

Every Georgian-registered business that has service expenses from abroad, whether VAT registered or not.

What Is Reverse Charge VAT?

Very few foreigners are aware of the term “Reverse Charge VAT” – or more simply, reverse VAT – because it is an uncommon tax in most countries. However, it is a very real consideration in Georgia (Article 161 of the Tax Code of Georgia “TCG”).

The reverse charge is the amount of VAT you would have paid on that service if you had bought it in Georgia instead of from abroad.

What Incurs Reverse VAT?

Every single service purchased from a foreign provider for business purposes incurs reverse VAT.

You will have to declare and pay reverse VAT if:

- You are a Georgian registered business and

- You purchase services from a foreign-based natural person/legal entity

How to reduce your reverse VAT payments to zero

If you are not VAT registered, then you must declare and pay the reverse VAT.

However, if you are VAT registered, though you are still required to declare all reverse-VATable transactions, you can simultaneously claim them back and effectively reduce your reverse-VAT payments to zero. This significant difference in tax is made possible simply by being VAT registered.

If you generate more than 100k GEL of VATable turnover in any rolling 12-month period, you are already liable to register for VAT. For many businesses based in Georgia that have exclusively foreign clients (B2B), your VAT turnover may be zero, and as a result, you have not yet considered registering for VAT.

However, as those B2B transactions are VAT exempt anyway, choosing not to register for VAT means you leave yourself open to reverse VAT payments on all service purchases from abroad, as well as regular VAT payments on local business-related purchases in Georgia. You could instead be claiming back all that purchase VAT, while still not owing any VAT on your own international products and services.

If you also sell services/products in Georgia domestically, or if you are selling to non-exempt B2C consumers, then your decision is more complicated. Otherwise, registering for VAT is a no-brainer.

If you still aren’t sure what would be best for you, or if you need help with your VAT registration or with your monthly reverse VAT declarations, you can get a free consultation from one of our experts at ExpatHub.

VAT Responsibility, In Simple Terms

Still confused? Here is an action summary and some detailed examples.

Reminder: VAT and reverse-VAT declarations are completely separate reporting mechanisms. They are mutually exclusive. Which one you need to file will depend on your VAT status and if you made service purchases from abroad that incur reverse VAT.

Are you VAT registered?

No, Not VAT Registered

- You MUST file monthly reverse-VAT declarations in the RS portal (see below) for every reverse-VATable purchase transacted with a foreign company or a natural person based outside Georgia where Georgian VAT was not already collected. You must then pay 18% on all of those purchases.

- You CANNOT claim back VAT on purchases made in Georgia where VAT was collected at source.

- NO VAT declarations are required. Only the separate reverse VAT declaration.

This is in addition to your regular annual/monthly income declarations and salary (payroll) or other declarations required, depending on your business.

Example:

Jack owns a small business in Georgia. He is not VAT registered.

In March, Jack sells services to 3 business clients (B2B). 2 from Australia and 1 based in Georgia. The services rendered to Australian clients are VAT-exempt, as they are businesses based abroad. The service provided to the Georgian client is classified as a VATable operation, but as Jack is not VAT registered, VAT is not charged on the services provided. No VAT declarations are required.

In March, Jack also purchased two annual software subscriptions (Zoom and Salesforce) from US companies online, as well as buying a new desk for his home office from a Georgian furniture store. As no Georgian VAT was collected on the software purchases, Jack must declare the price of those purchases on his reverse-VAT declarations, and then pay 18% of the total.

As Jack’s new desk was purchased from a Georgian shop where VAT was collected at the source, he has already paid VAT and will not need to declare or pay anything else. Jack CANNOT claim back this VAT.

In April, Jack buys a printer from a local store. He doesn’t buy anything from abroad. VAT has already been paid on the printer at source. As he doesn’t purchase anything that would incur reverse VAT, he does not have to file a reverse VAT declaration for the reporting month of April.

Yes, VAT Registered

- You MUST file monthly reverse-VAT declarations in the RS portal (See below) for every reverse-VATable business purchase where Georgian VAT was not already collected. Because you are VAT registered, you can simultaneously claim back the 18% reverse VAT owed, so you will effectively pay zero.

- You must file your monthly VAT declarations (separate declarations from reverse VAT).

- You CAN claim the amount of VAT that was collected from you back against your total VAT bill.

This is in addition to your regular annual/monthly income declarations and salary (payroll) or other declarations required, depending on your business.

Example

Mindy is VAT-registered in Georgia. She sells digital marketing services to 2 clients in the UK and 1 client in Georgia. The UK clients, being B2B and outside Georgia, are VAT-exempt here and no VAT is charged to them. The Georgian client is charged by VAT, which Mindy collects when she charges the client. Mindy will file a monthly VAT declaration where she will include her non-VATable turnover (income from the UK clients), as well as her VATable turnover (income from the Georgian client), and then will pay 18% on the VATable turnover.

In March, Mindy purchases two annual software subscriptions (Zoom and Salesforce) from US companies online, as well as buying a new desk for her home office from a Georgian furniture store. As no Georgian VAT was collected on the software purchases, Mindy must declare the price of those purchases on her reverse VAT declarations. Because Mindy is VAT registered, she can simultaneously claim back the 18% reverse VAT, effectively paying zero reverse VAT.

As Mindy’s new desk was purchased from a Georgian shop where VAT was charged at the source, she has already paid VAT. However because she is VAT registered, she will be able to claim back that VAT when she files her monthly VAT declaration. If that claimed VAT exceeds the VAT she owes based on charging her Georgian client by VAT, then rather than Mindy owing the RS money, the RS will actually owe Mindy money. This will be offset against Mindy’s monthly income tax payment.

In April, Mindy buys a printer from a local store. She doesn’t buy anything from abroad. VAT has already been paid on the printer at source, Mindy can claim the 18% back on her next VAT declaration, which must be filed. As she doesn’t purchase anything from abroad that would incur reverse VAT, she does not have to file a reverse VAT declaration at all for the reporting month of April.

Should I Become VAT Registered?

If your VATable turnover exceeds 100k GEL it is mandatory to register. However, for many foreigners, whose clients mostly are foreign registered businesses, it’s unlikely that their VATable turnover will ever reach 100k GEL. So for them, VAT registration is a choice.

The questions to ask yourself:

- Do I buy things in Georgia where I am paying 18% VAT?

- Do I buy services from foreign providers for business purposes where I have to pay 18% reverse VAT?

- Will I have to charge VAT on the products and services I sell?

If you regularly have to pay 18% on your purchases, but you never have to charge VAT on the provision of your services, then the answer is obvious: Get VAT registered and start claiming back the 18%.

If you have a mix of Georgian sales (or plan to in the future) and international sales, (meaning you will have to charge 18% on all your Georgian sales), then you have to consider if adding 18% to your local prices will cause you to lose enough clients that it’s better to just pay the 18% on purchases. Or, are all your Georgian clients VAT-registered businesses, who will claim back the VAT anyway, so it wouldn’t be an issue? How much money are you losing on purchases? If you rarely purchase anything, then it might be better to just pay the 18% on those rare occasions.

By becoming VAT registered, you also increase your accounting responsibilities, you will be required to file monthly VAT returns and to correctly make domestic purchases using your Tax ID so that those purchases can have the VAT claimed back. If your accounting costs are below the savings you will make, this is another reason to get VAT registered and just let someone else deal with the paperwork.

NOTE: Once you register as a VAT payer you cannot un-register until one year has passed. So make sure you understand what your liabilities will be. If you need help, book a free consultation (new customers only).

How To Declare Reverse-VAT

Whether you are VAT registered or not, you are still required to make reverse-VAT declarations each month if you purchased anything that qualifies (as defined at the start of this article).

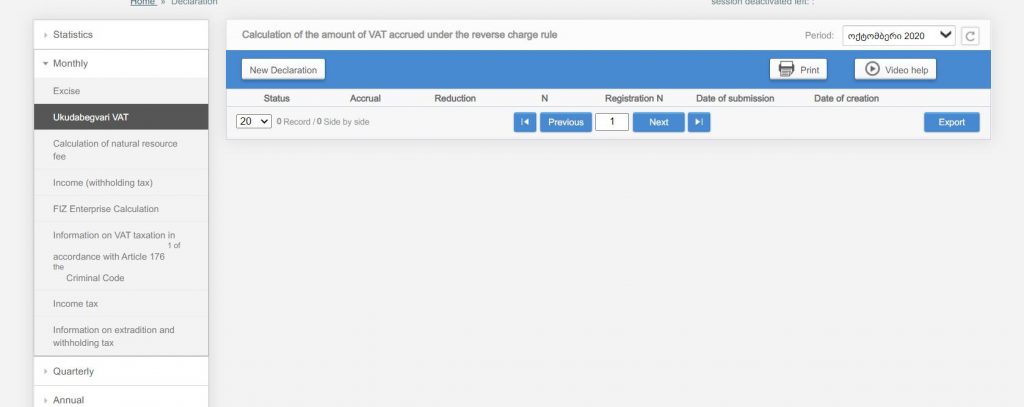

All reverse VAT declarations can be done through the RS portal within the monthly declarations section. The very poorly translated (thanks RS!) item highlighted in the image below from your monthly declarations section is the correct place to create a new declaration.

Once you are registered for VAT, you are also required to make monthly VAT declarations. If all your business products and services are supplied to foreign clients (B2B), or exempt for some other reason, your payments will be zero, but the declarations still have to be made showing how much non-VATable income was transacted each month.

Our accountants can take care of all your monthly declarations including revenue, VAT, and reverse-VAT, and offer protected liability compared to filing your own taxes. Get a free consultation from one of our expert tax advisers at ExpatHub.