If you’ve spoken to any number of Tbilisi Expats or hung around the related Facebook groups, you’ve probably heard of countless horror stories about shipping one’s personal belongings to Georgia.

You may have been told that customs will hold your stuff for months. Or perhaps that it will cost you an arm and a leg in import duties. Some unfortunate people have even had their things confiscated altogether.

While most of those stories are, no doubt, accurate, this doesn’t have to be your experience. And I’m happy to say that it wasn’t ours, either.

This is a story of how we shipped our belongings (7 boxes worth) from the UK to Tbilisi. The whole thing took less than a week and cost us roughly $300 in shipping and $175 in customs duties, with nothing getting held or confiscated, and for the most part, not even opened.

If you want this to be your experience too, read on.

Step 1: It All Begins with Good Planning

Most of the horror stories you read on Facebook have one thing in common: poor planning. In most cases, it’s not deliberate. Just not knowing any better is usually the culprit. And with the rules around the import of personal items being relatively complex and sometimes, downright ridiculous, no-one can blame anyone for that.

There are a few key things to keep in mind in the planning phase.

Firstly, you will need an inventory list of your things.

Not having an inventory list written out is where most of the issues originate. The Georgian customs, as well as the shipping company, will want to know exactly what your boxes contain.

I’ve heard of stories of people getting away with grouping together “used clothes” for instance, but if you don’t want to take any risks, do yourself a favor and write it out. I’m talking “light blue dinner jacket” and “19 pairs of socks”.

We were lucky to have gone through this exercise already during our packing. Doing this takes time, but it’ll be worth every second if you consider the alternative: the genuine risk of having your items held by customs for months and paying a customs bill that’s in the thousands.

Step 2: Pick the transportation service wisely

When it comes to choosing the delivery service, a lot will depend on where you’re moving from.

We shipped our stuff from the UK, so our options were, more or less, limited to Royal Mail, an international courier service (DHL, UPS, etc.) or KiwiPost.

DHL and UPS were out first, as the prices were entirely out of whack. Our second choice was KiwiPost – they’re like USA2Georgia.com, but do both the USA and UK as well. And as their pricing was reasonable (they offered a discount from the usual prices as it was personal items), and they seemed to know what they’re doing, we went with them.

And boy, am I glad we did.

I genuinely believe the decision to go with Kiwi was what made the biggest difference, as they took care of literally all of the paperwork for us. Elora emailed them the inventory list, and the next we heard from them was when they called us to say that our boxes were in Georgia and would be delivered the next day.

The price is $7 per kilogram for shipping from the US and £5 for shipping things from the UK, so it’s approximately 22 GEL per kg.

In fairness, other similar providers would likely do the same. If you’re shipping from the States, then USA2Georgia is probably a good option, and there are many more.

The bottom line is to go with a provider who does this often and has experience with shipping personal items. UPS might be reliable when it comes to shipping documents, but you’d be on your own with the customs paperwork.

Step 3: Get Your Values Right

Here’s where the “fun” begins.

You may have heard that the Georgian customs will want to know the value of every item that you’re shipping over, and you’re right.

That begs many “interesting” questions, such as “How much is a pair of used socks worth?” and “Do I really need to list every item???” The answers to those questions are, respectively, “Probably about $1” and “Yes.”

I’ll try to make it as clear as I can: your inventory list has to include the value of every item that you’re shipping over. As for how to determine this value, if you asked five people you’d probably get five different answers, (and that includes the people at the Revenue Service itself), but here are the loose rules that we went by:

- For brand new, unused, or barely used items, the value is what you paid for it.

- For used items that have resale value (say, electronics), the value is what you’d be able to buy the item for on eBay.

- For used items that don’t have realistic resale value (say, a pair of socks), the value is a symbolic $1.

- For items that cannot be sold (say, documents, or Christmas cards), also a symbolic $1, since according to customs, everything needs to have a value.

Now, I know that some people have gotten away with things like listing all their clothes as a single item and putting $5 as the collective value, but that’s not the point. I also know many people who have had their stuff either revalued, held at customs for months, or both. In my opinion, it’s far better to play it safe, even if it means paying an extra $50 in tax, than to take a risk and be sorry.

All of this often raises another question, though: “Who’s to say whether my valuation is accurate or not?“

And the answer is simple – it’s the customs agent.

The bottom line is this: if your valuations seem about right, you’re likely to not go under scrutiny. In our case, customs didn’t even open most of our boxes. But the moment you try to be funny and value your $150 watch at $30 to save a bit of money, they’re likely to go through all of your stuff and present you with a list of what THEY think the real values are.

That’s resulted in situations where, say, a lot with a self-declared value of around $1,000 has been revalued by the customs at $5,000. And that’s a situation that you probably don’t want to end up in, considering it means an additional $1.2k in tax.

Wait, so, how much is the tax anyway?

For most items, it’s 18% VAT.

There are some exceptions to this where you also need to pay import duty (either 5% or 12% on top of the VAT) but for most household items, you’ll be paying the standard 18% tax.

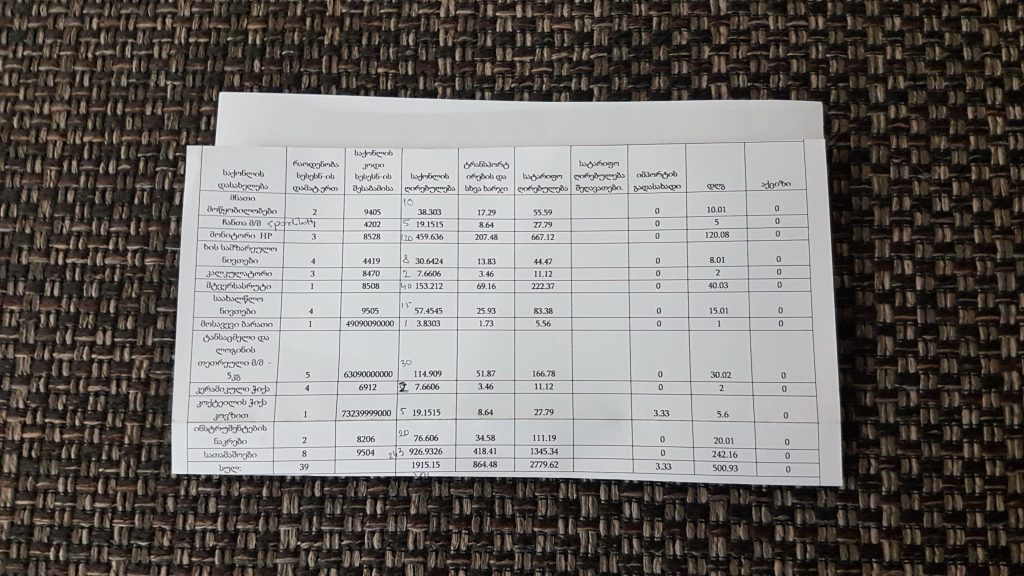

For example, according to the customs bill, we paid the additional 12% import duty on only one item… a measuring cup.

There are also cases where you qualify for a discount, such as if you’re a diplomat or if you can prove that the import is temporary.

Once again, though, a decent freight provider will assist you here. Or, if you feel brave, you can go to the Revenue Service and ask them directly, although, in my experience, it’s not very easy to get a concise answer out of them.

But let’s move on…

Step 4: Get Yourself a Tax ID

While your goods are in transit, you need to pay the Revenue Service a quick visit to get yourself a Georgian Tax ID. You’ll need it to pay the import tax, which, in turn, you’ll need to get your items cleared by customs.

Show up at any of the multiple RS Service Centres (I went to the Vake-Saburtalo one), say that you want to get a tax ID or tax number, sign the form that you’re given, and walk out 10 minutes later with the number in hand.

Be aware that as soon as you register on the RS system, you are on their radar. If you earn income while being physically present in Georgia, whether from abroad or domestically, you are likely liable for tax.

It’s best to discuss your tax options with an adviser before registering so you know you are doing everything correctly and don’t end up incurring unnecessary taxes on your income.

Learn more about the best way to move your taxes to Georgia.

Step 5: Wait for a Phone Call

From here on, it’s the waiting game.

Once your shipment is in Georgia, your shipping company will let you know the details, ask you to pay the tax (you can do this online if you have a local bank account or through one of the many pay boxes) and you’re all done.

You’ll then likely need a day or two for your items to clear customs. For us, it was basically immediate and customs only ever opened one of our several boxes.

Bottom Line & One More Tip

So, there you have it.

While I can’t guarantee that following this process will result in an experience as smooth as ours was, we did a fair bit of research and avoided a lot of the mistakes that people commonly make.

I’m personally very grateful to all the people who shared their stories with us and helped us, and I’m hoping that the publishing of our story will, in turn, help many of you.

But keep in mind that this is just one story. And do let us and others know in the comments below if your experience has been different from ours.