Our quick guide to making your tax payments to the Revenue Service (Treasury) in the Republic of Georgia.

Once your monthly or annual taxes have been filed via the Revenue Service Online Portal, you will need to pay the required taxes to the Treasury. This can be done via any local Georgian bank using their online portal.

There are also some limited, but inconsistent, options for paying from abroad.

The below method also works for most other types of taxes that may be owed to the Revenue Service – including outstanding payments of import tax and VAT if you purchased goods from abroad and are required to pay tax on them.

NOTE: If you earn income while being present in the territory of Georgia, whether the source of that income is local or international, you may owe income tax. Read more about tax for remote workers in Georgia here, or book a free consultation.

How to Pay Your Tax From A Georgian Bank

If you are a monthly accounting client with ExpatHub, even though we will do the tax calculation for you, you’ll still need to make the payments yourself, unless we’ve agreed otherwise. If we do not handle your accounts, then obviously you must file your accounts yourself.

It’s very important that you follow our instructions exactly. Failing to do so can result in your tax payments being misallocated and can lead to interest and penalties.

NOTE: The below instructions allow you to pay from any Georgian bank account, you do not have to pay from your own account or from the account of your business.

To make the process easier each month, you can save the below action as a template. Or you can select the previous month’s transaction and click the repeat transaction button, then just adjust the payment amount as required, and double-check the details before submitting.

Personal Bank Account

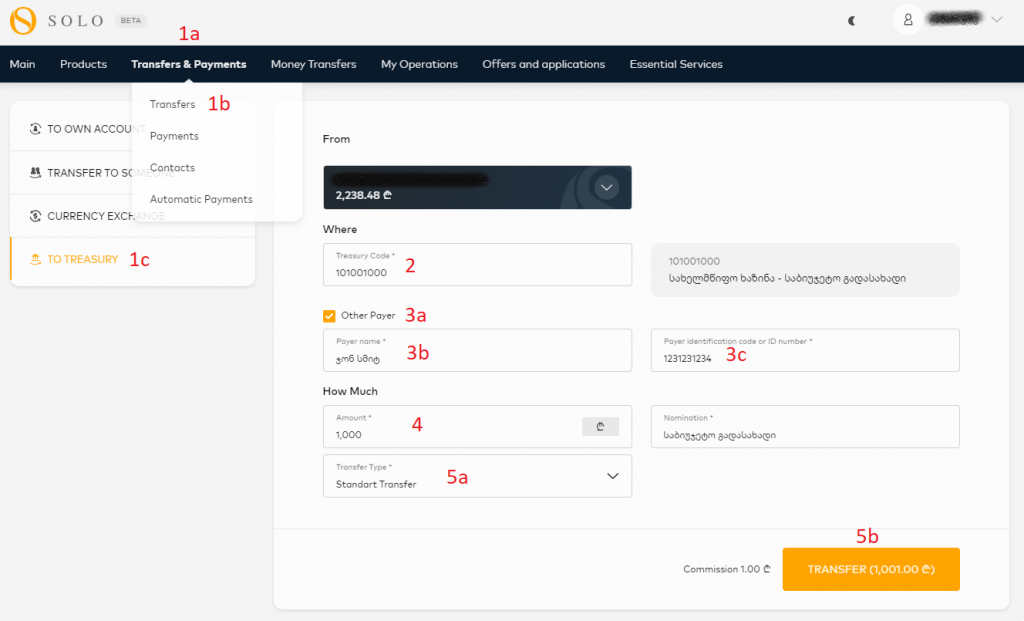

Bank of Georgia & SOLO

- Under Transfers & Payments, click Transfers, then Treasury.

- Enter “101001000” in the Treasury Code field.

- Tick the Other Payer box, then enter your name in Georgian (exactly as it appears on your RS account) and your tax ID.

- Enter the monetary amount in GEL that you need to pay. (For our monthly accounting clients, we’ll send you the figure in advance.)

- Choose Standard Transfer and click TRANSFER.

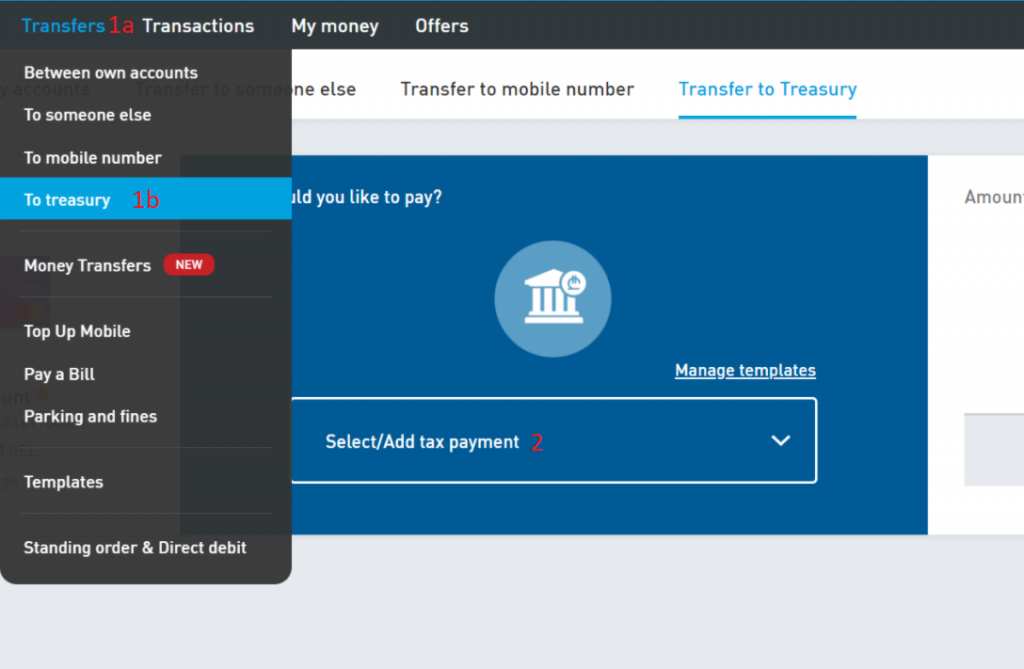

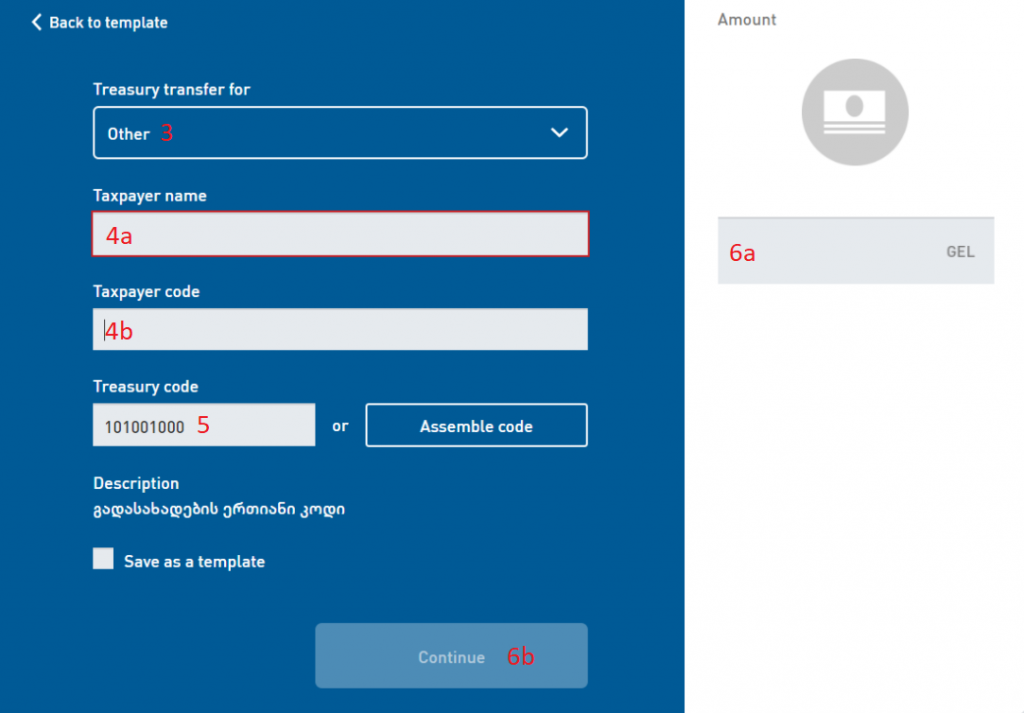

TBC Bank

- Click Transfers, then Treasury.

- Click Select/Add tax payment, and choose New Tax Payment.

3. In the Treasury transfer for box, select Other.

4. Enter your name in Georgian and your tax ID in the corresponding boxes.

5. Enter “101001000” as Treasury code.

6. Enter the monetary amount in GEL that you need to pay. (For our monthly accounting clients, we’ll send you the figure in advance.)

Business Bank Account

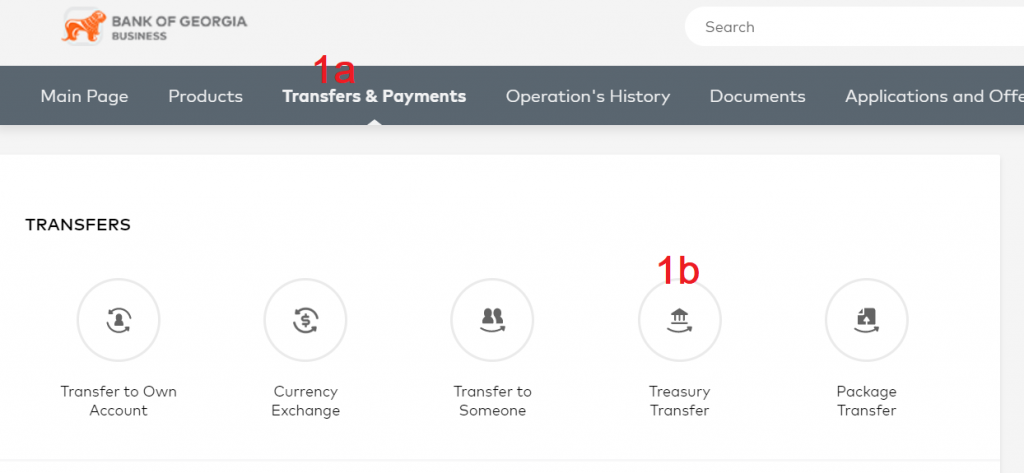

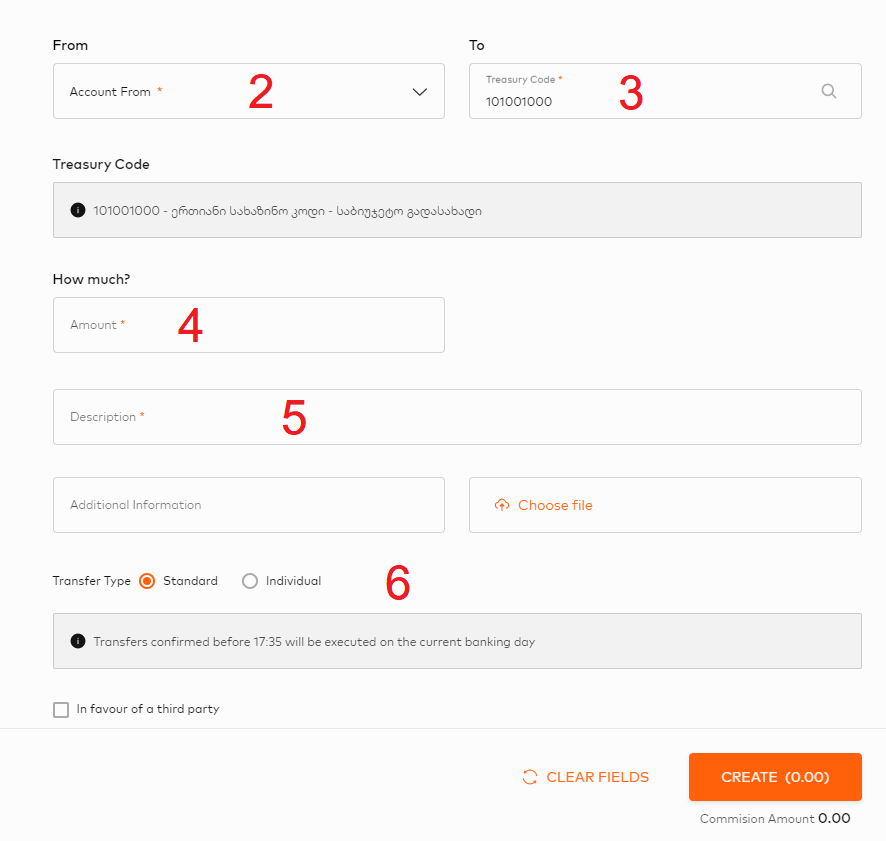

Bank of Georgia

- Under Transfers & Payments, click Treasury Transfer.

- Choose the account you want to transfer from.

- Enter “101001000” in the Treasury Code field.

- Enter the monetary amount in GEL that you need to pay. (For our monthly accounting clients, we’ll send you the figure in advance.)

- Description “საბიუჯეტო გადასახადი”.

- Choose Standard and click TRANSFER.

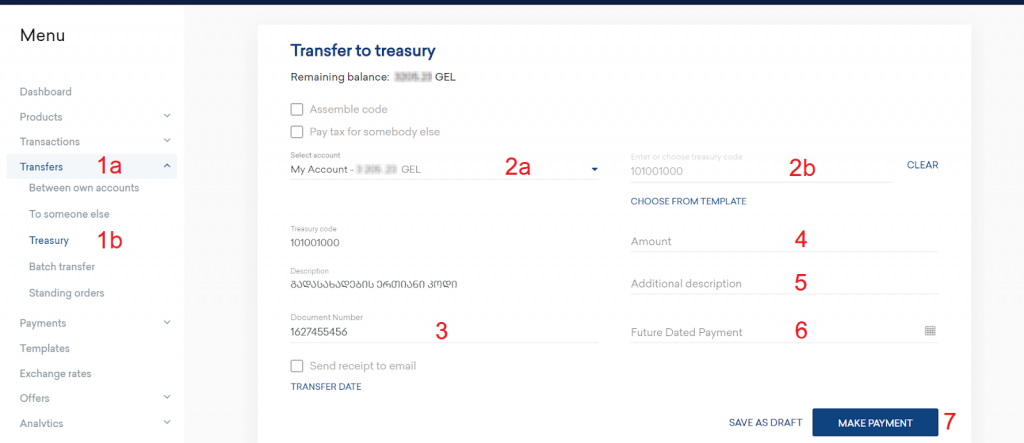

TBC Bank

- Under Transfers, click Treasury.

- Select your account, Enter “101001000” in the Treasury Code field and then click check.

- The document number is generated automatically.

- Enter the monetary amount in GEL that you need to pay. (For our monthly accounting clients, we’ll send you the figure in advance.)

- Additional description: “საბიუჯეტო გადასახადი”.

- Skip this step unless you want to schedule payment for a future date.

- Click MAKE PAYMENT to finalize the transaction.

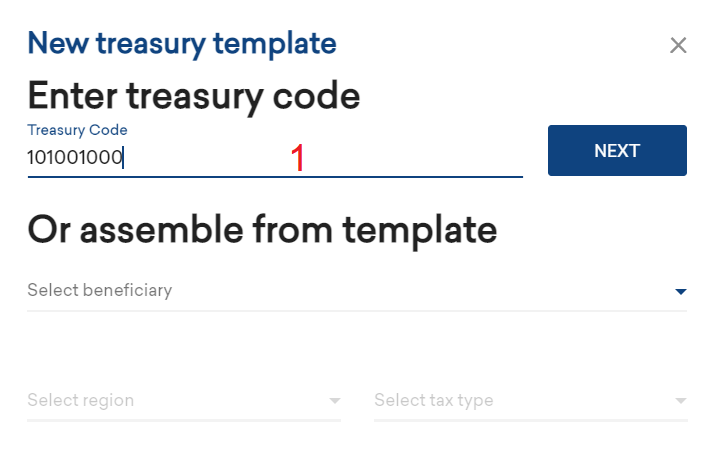

Create a template at TBC

- Choose Templates from the Menu, enter “101001000” in the Treasury Code field, and then click NEXT.

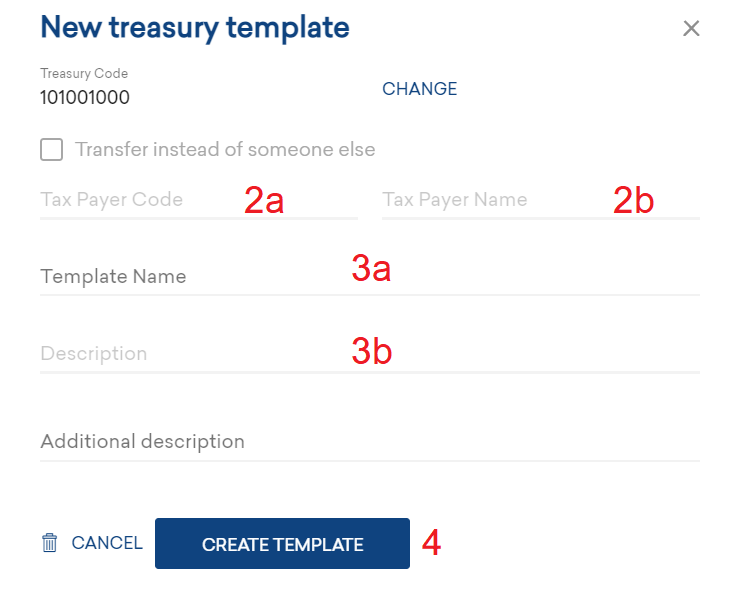

- Enter your tax ID and your company name in Georgian (exactly as it appears on your RS account).

- Choose a name for your template, it can be in English. Add description and additional description “საბიუჯეტო გადასახადი”.

- Click CREATE TEMPLATE.

Note: Given that the RS is notorious for mismatching tax payments even if they’re made correctly, we strongly recommend you to check each month in your RS.ge account whether your payment was received and accepted.

For ExpatHub monthly accounting clients we check for you, at the end of each month, if your payment was accepted.

If you are an employee, or Individual Entrepreneur without the 1% tax rate, and hence typically only need to file annually, you can learn more about your annual filing responsibilities here.